In today’s digital age, the rise of online investment platforms has also led to an increase in scams targeting unsuspecting individuals. One such platform that has raised alarm among users is Vroec (vroec.com). This blog post aims to expose the tactics used by Vroec to defraud its users and provide essential information on how to recognize and protect yourself from scams in the online investment landscape.

What is Vroec?

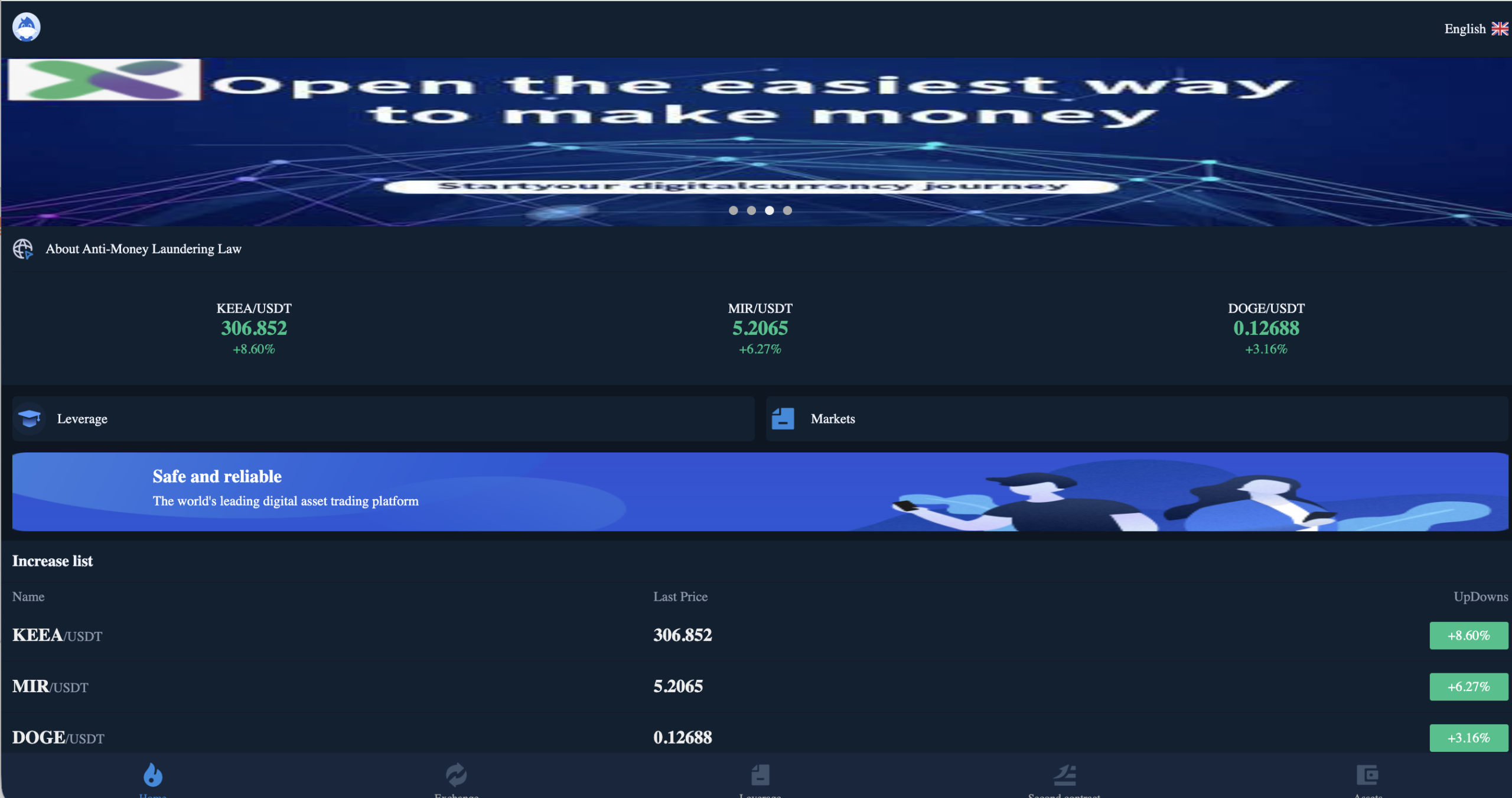

Vroec positions itself as an investment platform offering various financial services, promising users attractive returns and advanced trading tools. At first glance, it may seem like a legitimate opportunity for investors looking to grow their wealth. However, a closer examination reveals that Vroec operates through questionable practices, indicating a strong likelihood that it is a scam.Common Scam Tactics Employed by Vroec

1. Inflated Promises of Returns

One of the main tactics used by Vroec is its promise of exceptionally high returns, often exceeding market averages. This creates an enticing narrative for potential investors, who may be eager to believe in easy wealth. Such unrealistic expectations are designed to lure users into depositing their funds without conducting adequate research.2. Lack of Regulatory Compliance

A legitimate investment platform operates under the supervision of recognized financial authorities, ensuring that it adheres to specific standards and regulations. Vroec, on the other hand, appears to operate without any regulatory oversight, raising significant concerns about the safety of user investments and consumer protections.3. Hidden Fees and Charges

Users of Vroec frequently report encountering hidden fees that were not disclosed when they initially signed up. These fees can add up quickly, significantly reducing the overall returns that users may expect. Such practices are often indicative of a scam, where the platform profits off the unsuspecting nature of its clients.4. High-Pressure Sales Strategies

Once a visitor shows interest in investing, Vroec’s representatives may employ aggressive sales tactics to pressure users into making quick decisions. This creates a false sense of urgency, pushing individuals to invest without allowing them time for proper consideration or research.Recognizing the Red Flags

Identifying scams is crucial to protecting your financial interests. Here are some red flags that may indicate a potential scam:- Guaranteed Returns: If a platform guarantees profits, beware. Every investment carries risks, and no one can guarantee consistent earnings without exposing you to potential losses.

- Vague Contact Information: Reliable investment platforms provide clear, accessible contact details and customer service. A lack of transparency in communication can be a significant warning sign.

- Poor Online Reputation: Difficulty finding credible information or testimonials about the platform should raise alarms. Established platforms typically have an extensive digital presence, including user reviews and feedback.

- Pressure to Invest Quickly: If the platform’s representatives are urging you to transfer money immediately, it’s essential to pause and reassess. Good investment decisions require time and careful evaluation.

Tips for Staying Safe Online

Protecting yourself from online scams is essential in today’s digital investment climate. Here are several strategies to safeguard your financial interests:- Conduct Thorough Research: Always perform extensive due diligence before investing in any platform. Look for user reviews, feedback, and any warnings about the platform’s legitimacy.

- Seek Professional Advice: If you have doubts about a platform, consult with financial advisors or professionals who can provide guidance tailored to your specific situation.

- Trust Your Instincts: If something feels off about a website or its representatives, trust your gut feeling. It are generally wise to exercise caution when it comes to financial commitments.

- Be Wary of Unsolicited Offers: Unsolicited emails, texts, or calls promoting investment opportunities are often scams. Be skeptical of such communications and avoid engaging with them.

Importance of Financial Literacy

Enhancing your financial literacy can empower you to make informed investment choices. Consider the following ways to improve your understanding of finance:- Online Courses: Many reputable organizations host free or affordable courses focusing on investment basics and market trends, enabling you to make better-informed decisions.

- Books and Blogs: Reading investment literature can provide valuable insights and deepen your understanding of investment concepts and market dynamics.

- Join Investment Groups: Engaging with others in the investment community can facilitate discussion and offer diverse viewpoints, enriching your understanding and providing support.

Conclusion

Vroec serves as a stark reminder of the potential dangers hidden in the online investment world. By understanding the tactics employed by such platforms and maintaining vigilance, you can better protect yourself from falling victim to scams. Effective investing requires careful consideration, thorough research, and informed decision-making. At ForemostReclaim.com, we recognize the challenges faced by individuals who fall prey to online scams. Our expert team specializes in helping victims recover their funds and educating clients on safe investment practices. If you believe you’ve been affected by a scam, reach out to us at info@foremostreclaim.com. Taking that first step toward reclaiming your hard-earned money is crucial for your financial well-being.Empowering Yourself to Stay Informed

Awareness and education play pivotal roles in navigating the complex landscape of online investments. By staying informed about scams like Vroec, you equip yourself with the tools needed to recognize and avoid fraudulent platforms. Regularly updating your understanding of investment strategies, market conditions, and common fraud tactics can help you make informed decisions and secure your financial future.Resources for Ongoing Education

- Webinars and Workshops: Many financial experts offer regular webinars or workshops, providing insights into current market trends and investment strategies.

- Podcasts and Videos: There are numerous podcasts and YouTube channels dedicated to financial education that can help broaden your understanding of investing and fraud prevention.

- Financial News Outlets: Subscribe to reputable financial news platforms for the latest updates on market conditions and scams, keeping you informed about potential threats.