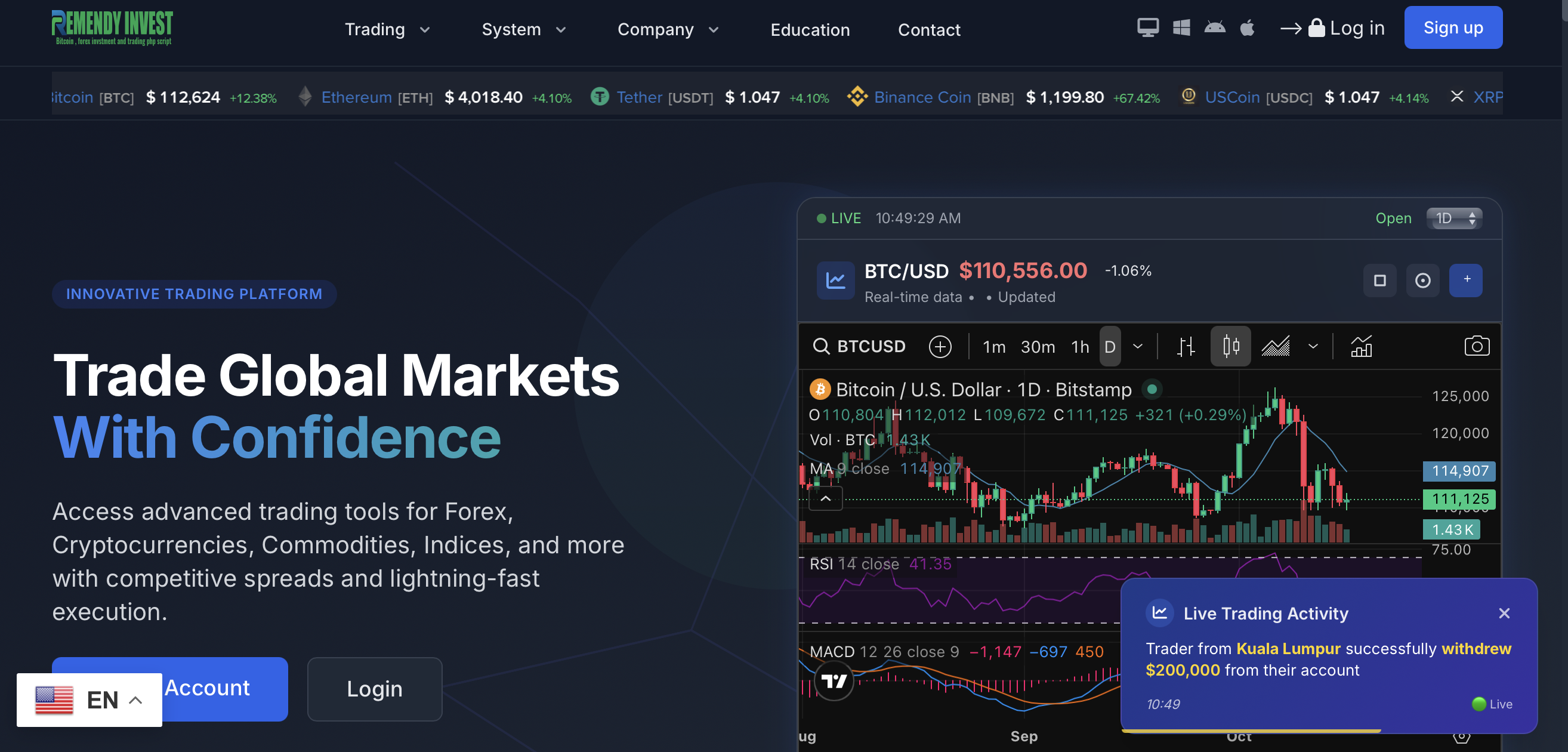

REMENDY INVEST, operating via remedyalgotradescript.sbs, positions itself as a sophisticated investing and algorithmic trading platform. The branding suggests professionalism, opportunity, and advanced tools. Yet a closer inspection reveals multiple red flags that align with common scam broker patterns: no verifiable regulation, obstructed withdrawals, pressure sales tactics, and opaque ownership. This detailed review explains how the scheme typically operates, the specific warning signs to look for, and why REMENDY INVEST should be avoided if you care about safety, transparency, and accountability.

Summary for Readers and Search Engines

- REMENDY INVEST (remedyalgotradescript.sbs) exhibits hallmarks of a scam platform, including an absence of credible regulation and serious transparency gaps.

- Reported issues include blocked withdrawals, sudden “fees,” and shifting terms, all typical of unlicensed brokerage schemes.

- The domain patterns, contact ambiguity, and aggressive deposit tactics mirror boiler-room operations that frequently rebrand to evade scrutiny.

What REMENDY INVEST Promises vs. What Users Encounter

Scam platforms thrive on persuasive marketing. They pitch automated strategies, expert support, tight spreads, and near-guaranteed success. The journey often begins with:- “Limited-time” deposit bonuses and premium tiers.

- Claims of AI-driven trading with impressive win rates.

- Guided onboarding by an “account manager.”

- Early “profits” displayed on dashboards don’t materialize when cashing out.

- Withdrawal requests trigger new hurdles: extra verification, taxes, liquidity fees, or trade-volume requirements.

- Communication becomes sporadic or scripted once larger deposits are made.

Key Red Flags That Indicate a Scam

Use these markers to assess REMENDY INVEST and similar sites:- No verifiable regulation: Legitimate brokers list regulator names and license numbers that you can independently confirm. Unregulated entities may use vague compliance language without proof.

- Anonymous or opaque ownership: Safe platforms publish a legal entity, registered address, and leadership details. Scam sites often hide or rotate this information.

- Aggressive deposit pressure: Repeated calls, high bonuses, and urgency tactics push you to fund quickly before thinking critically.

- Withdrawal obstruction: New rules appear only when you request funds: “tax” payments, AML “holds,” or mandatory upgrade fees.

- Unrealistic returns: “Guaranteed” profits or consistently high win rates contradict how real markets work.

- Vague terms and shifting policies: Unclear contracts allow the platform to change the rules at will.

- Thin digital footprint: Recently created domains, low traffic, recycled templates, and generic testimonials suggest a disposable operation.

The Scam Playbook: How the Funnel Works

- Attention capture: Ads, social posts, and cold outreach promise easy profits and “AI trading.

- Illusory gains: The dashboard shows rising balances to build trust and entice bigger deposits.

- Upsell pressure: “Unlock” better returns with higher tiers or time-sensitive trades.

- Silence or blame: Support blames “security reviews,” third-party delays, or your “trading behavior.”

Why Proper Regulation Matters

Regulated brokers must segregate client funds, publish risk disclosures, and adhere to strict auditing and dispute processes. They also:- Provide a clear company registration with a regulator you can verify.

- Maintain transparent fee schedules and policies.

- Offer realistic risk warnings rather than “guaranteed profit” narratives.

- Process withdrawals without invented post-hoc conditions.

The Psychology Behind the Pitch

Understanding the persuasion tactics reduces vulnerability:- Scarcity: Countdown timers and “last slots” push impulsive deposits.

- Authority: Pseudo-experts and fabricated credentials convey false legitimacy.

- Social proof: Stock-photo testimonials and cherry-picked “wins” simulate community success.

- Reciprocity: “Bonuses,” “signals,” and “VIP tips” create a sense of indebtedness.

Typical Withdrawal Barriers Used by Scam Platforms

- Bonus traps: Hidden terms require impossible trading volumes before any withdrawal.

- Surprise fees: “Tax,” “liquidity,” or “unlock” charges that real brokers never impose.

- Perpetual KYC loops: Endless document rejections with vague reasons.

- Account freezes: Sudden flags for “suspicious activity,” no clear remediation timeline.

What Credible Trading Platforms Offer (That REMENDY INVEST Doesn’t)

- Regulators and licenses you can independently confirm.

- Clear, stable terms and a published fee schedule.

- Negative balance protection and documented margin rules.

- Realistic marketing about risk and volatility.

- Responsive, accountable support with traceable case numbers.

Accessibility, Inclusion, and Usability Concerns

Scam operations often neglect basic standards:- Inconsistent dashboards and unexplained balances.

- Poor accessibility: low contrast, missing labels, inaccessible forms.

- Limited language support and time-zone-restricted help.

- Scripts that pressure users rather than respecting individual pace and needs.

Five-Step Safety Check for Any Broker

- Verify regulation directly: Use the regulator’s public register. Confirm the legal entity, not just a brand name.

- Match corporate details: Check the registered address, directors, and company number across official sources.

- Test withdrawals early: Start small, attempt a withdrawal immediately after a few simple trades.

- Read the entire terms: Search for “bonus,” “withdrawal,” “fees,” and “liability” to find traps.

- Audit the footprint: Domain age, leadership transparency, third-party reviews, and consistent communications matter.

Patterns Consistent with Boiler-Room Schemes

- Template websites cloned across multiple domains.

- “Account managers” who dodge direct regulation questions.

- Escalating pressure when you hesitate to deposit.

- Rebranding and domain hopping to escape negative coverage.

Inclusive Education: What Safe Learning Looks Like

Everyone deserves fair access to reliable financial education:- Clear, jargon-light explanations with realistic risk discussions.

- Non-deposit demo accounts with no upsell pressure.

- Respectful support that prioritizes informed decision-making.

- Transparent policies that value user autonomy.

I’m kindly asking if you can help me I invested all my money in this company I’m a student at Evelyn hone college in Zambia and I haven’t been able to get my investment on time please help me