Prime Wealth Traders has emerged as a controversial name in the online trading world, presenting itself as a trustworthy platform for investing in various financial assets. However, a closer look reveals numerous concerns about its legitimacy.

This review exposes the red flags associated with Prime Wealth Traders, analyzes real user experiences, and explains the broader dangers of engaging with such platforms.

Understanding Prime Wealth Traders

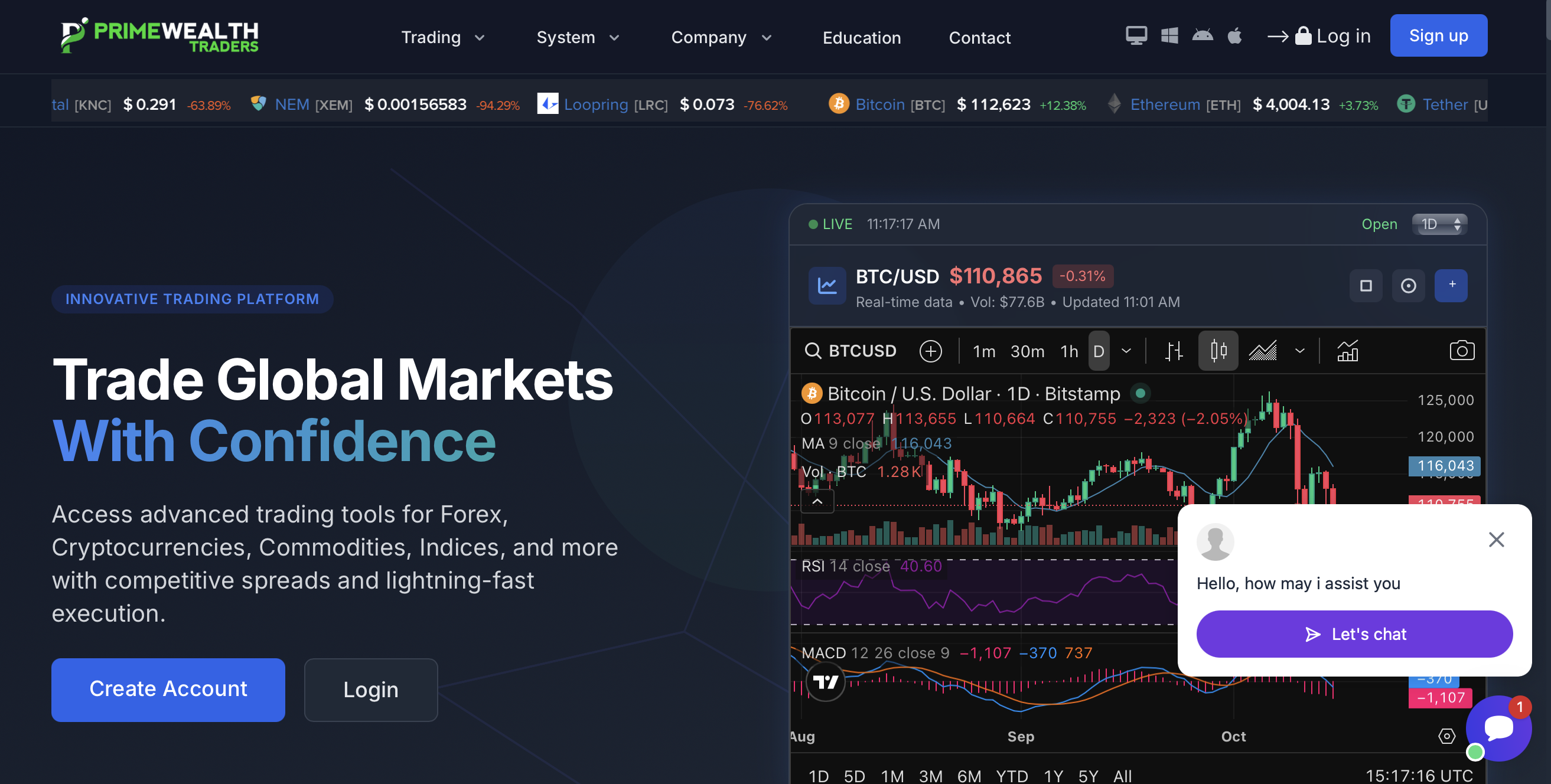

Prime Wealth Traders promotes itself as an online trading platform offering access to stocks, commodities, forex, and cryptocurrencies. It claims to provide innovative tools to help users maximize their profits.

While its marketing materials and testimonials appear convincing, it is essential to look beyond the surface and evaluate whether these claims hold up under scrutiny.

The Lure of High Returns

At the center of Prime Wealth Traders’ marketing is the promise of quick and high returns with minimal effort. These claims attract hopeful investors searching for rapid profits, but such unrealistic promises often mask deeper issues.

This temptation frequently blinds potential investors to clear warning signs that suggest the platform may not be legitimate.

Lack of Regulation

A major concern with Prime Wealth Traders is its lack of regulation. The platform does not appear to be supervised by any recognized financial authority, which means it may operate outside established legal and ethical frameworks.

Regulated brokers must meet strict financial and transparency standards designed to protect clients’ funds. The absence of oversight from regulators is a serious red flag that investors should not ignore.

Red Flags to Watch For

Identifying early warning signs can help protect you from significant losses. Here are the main red flags reported by users of Prime Wealth Traders:

1. High-Pressure Sales Tactics

Many users report aggressive sales calls from Prime Wealth Traders representatives. These agents use urgency and emotional manipulation to push people into depositing money quickly. Legitimate brokers encourage thoughtful decision-making, not rushed commitments.

2. Withdrawal Difficulties

One of the most common complaints is the inability to withdraw funds. Users describe encountering multiple obstacles, delays, or excuses when trying to access their money — a clear indicator of suspicious activity.

3. Poor Customer Support

Reliable customer service is critical for any trading platform. However, users claim that Prime Wealth Traders offers little to no assistance, with unresponsive or unhelpful support teams. This lack of communication damages user confidence and reflects poorly on the company’s credibility.

User Experiences — From Hope to Regret

Initial Excitement

Many investors start their journey optimistic, believing in the platform’s promises of success. The polished website and testimonials reinforce a false sense of trust and opportunity.

Realization and Regret

Once withdrawal issues arise and support disappears, optimism quickly turns into regret. Users often realize they may have been misled, experiencing financial loss along with emotional stress and anxiety.

Wider Consequences of Scam Platforms

Platforms like Prime Wealth Traders not only harm individuals but also damage trust in the financial industry as a whole.

Erosion of Trust

Investment scams cause widespread skepticism toward all online financial services, even legitimate ones. This makes it harder for honest companies to build credibility with potential clients.

Financial and Emotional Damage

Victims often suffer serious financial losses and emotional distress. Beyond losing money, many experience lasting feelings of shame, anger, and anxiety — consequences that can take time to heal.

How to Protect Yourself from Investment Scams

Protecting your finances starts with awareness and due diligence. Before investing:

-

Research the platform thoroughly — check for reviews and independent feedback.

-

Verify regulation — ensure the company is licensed by a recognized authority.

-

Avoid promises of guaranteed returns — no legitimate investment guarantees profit.

-

Be cautious with personal data — never share banking or ID information without verifying the company’s legitimacy.

The more informed you are, the better you can protect yourself from deceptive schemes.