Investing Banks has recently gained attention as an online investment platform, promoting various trading opportunities and financial products. However, beneath its polished exterior lies a troubling narrative of deception and exploitation. In this blog post, we will dissect the fraudulent characteristics of Investing Banks, explore user experiences, and outline protective measures against such scams.

Company Overview

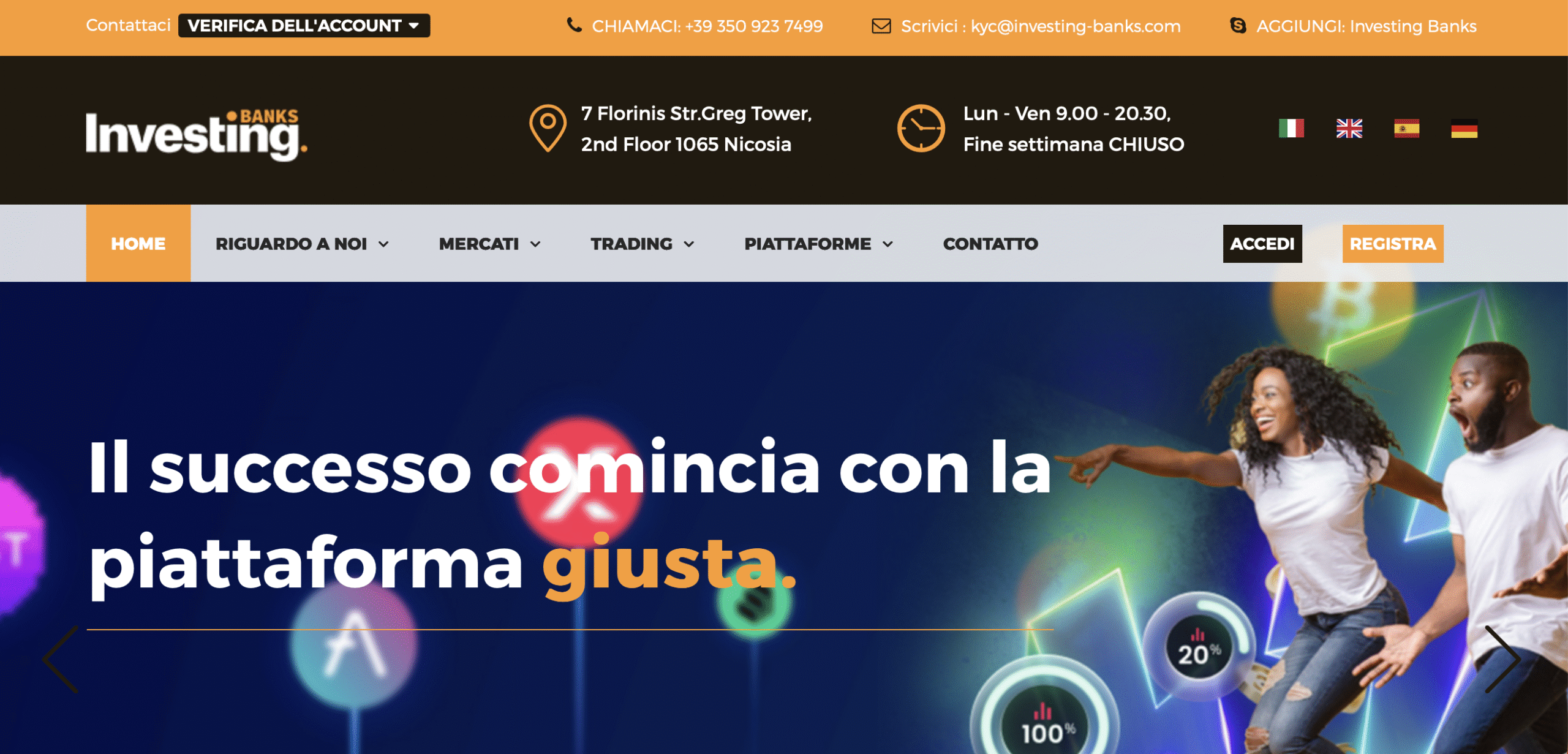

Investing Banks presents itself as a modern investment facilitator, offering users the chance to invest in stocks, commodities, cryptocurrencies, and more. The platform is marketed as being user-friendly and sophisticated, featuring an assortment of financial tools designed to help investors maximize returns. However, a deeper look reveals numerous red flags that raise concerns about its legitimacy.The Allure of Investing Banks

Scam platforms often thrive on the promise of high returns and convenience. Investing Banks capitalizes on this with alluring advertisements that depict an easy path to financial gain. Their slick presentation may attract many, especially those new to investing. However, the glitzy facade quickly falls apart upon closer examination.Key Red Flags

- Unrealistic Promises of Returns: Investing Banks claims that users can achieve substantial returns with minimal risk. In the world of investments, such guarantees are a significant red flag. Legitimate trading platforms don’t promise guaranteed profits; they acknowledge that all investments carry inherent risks.

- Lack of Regulation: A crucial aspect that distinguishes legitimate investment platforms from scams is regulatory oversight. Investing Banks is not registered with any known financial authorities, raising questions about its compliance with industry regulations designed to protect investors.

- Complicated Withdrawal Processes: Customer testimonials frequently highlight difficulties in withdrawing funds. Users report delays, unreasonable requirements for documentation, or outright refusals when attempting to access their own money, a tactic commonly seen in fraudulent schemes.

- Inaccessible Customer Support: Customer service is a fundamental component of any investment platform. However, Investing Banks has been criticized for its poor customer support. Users often find it challenging to receive timely assistance or explanations to their inquiries.

User Experiences and Testimonials

To gain a clearer picture of the reality behind Investing Banks, we must consider the experiences of users who have engaged with this platform. The testimonials reveal consistent themes of frustration and financial loss.Commonality in User Feedback

- Significant Financial Losses: Many users have reported losing substantial sums of money after investing with Investing Banks. These losses can often be attributed to hidden fees, misleading information, or aggressive sales tactics that encourage excessive investment.

- High-Pressure Sales Techniques: Victims often describe being pressured to invest larger amounts, with platform representatives assuring them of excellent returns. This pressure is a classic strategy used by scammers to exploit the eagerness of potential investors.

- Complex Account Management: Clients have reported challenges when attempting to navigate their accounts. Many users face obstacles when trying to log in, manage their investments, or initiate withdrawals, leaving them feeling frustrated and helpless.

Understanding the Tactics of Scam Platforms

To grasp how platforms like Investing Banks operate, it is crucial to identify the tactics commonly employed by fraudulent entities.Misleading Advertising

Scammers often create enticing advertisements that lure in potential victims. Investing Banks utilizes flashy graphics and impressive claims to create an illusion of credibility. However, these ads often lead to scams that lack substantial backing.Emotional Manipulation

Many fraudulent platforms prey on individuals' financial insecurities and desires for quick wealth. By showcasing success stories and testimonials from fake users, scammers foster a sense of urgency, compelling individuals to invest without carefully considering their decisions.Opacity and Lack of Transparency

Transparency is critical in investment transactions. However, platforms like Investing Banks often obscure crucial details about their operations and management. The absence of clear information regarding fees, personnel, and investment strategies should raise red flags for potential investors.Protecting Yourself from Scams

Fortunately, there are numerous strategies to protect yourself from falling victim to platforms like Investing Banks.- Conduct Thorough Research: Prior to investing, always verify the legitimacy of any platform. Investigate their regulatory status, read user reviews, and look for information from reliable sources. A simple online search may uncover potential warnings or testimonials from other users.

- Recognize Red Flags: Familiarize yourself with the common signs of investment scams. Watch for unrealistic promises, pressure tactics, undocumented claims, and poorly managed websites.

- Don’t Rush into Decisions: Scammers often create a false sense of urgency. Give yourself adequate time to assess opportunities and make informed decisions. Avoid impulsive actions based on fear of missing out.

- Seek Professional Advice:

If you're unsure about a platform's legitimacy, consider consulting with a licensed financial advisor. A professional can provide tailored advice and help you navigate the complexities of investing.

Legal Protections and Consumer Rights

Understanding your legal rights can empower you as an investor. Various consumer protection laws exist to safeguard individuals against fraudulent activities.- Regulatory Bodies: Familiarize yourself with the regulatory bodies in your country that govern financial markets. Organizations such as the Securities and Exchange Commission (SEC) in the United States and similar entities abroad provide oversight and guidance for investors.

- Fraud Reporting Mechanisms: Many countries allow victims of financial fraud to report incidents through specific channels. These reports can assist in the investigation and help prevent others from falling victim to the same scam.

- Consumer Education Resources: Numerous organizations provide resources and educational materials aimed at helping individuals recognize scams. Engaging with these materials can enhance your understanding and better prepare you to identify fraudulent schemes.

Community Awareness and Education

Creating a more informed community is crucial in combating scams like Investing Banks. Sharing knowledge and experiences can help raise awareness about the tactics used by fraudsters.- Educational Workshops: Consider organizing or participating in educational workshops focused on financial literacy and investing safety. These platforms can empower community members with the knowledge needed to make informed decisions.

- Online Forums and Social Media Groups: Engage in discussions within online platforms where individuals share their experiences with various investment opportunities. These forums can serve as a wealth of information and warning systems.

- Peer Support Groups: Form support groups for individuals who have experienced financial loss due to scams. Sharing personal stories and strategies for recovery can provide emotional relief and foster resilience among victims.

Conclusion

Investing Banks serves as a stark reminder of the dangers lurking in the investment landscape. With its enticing promises, lack of transparency, and troubling user experiences, it is essential for potential investors to exercise caution and diligence. Awareness and education are your best defenses against scams. By understanding the common tactics employed by fraudulent platforms, recognizing red flags, and seeking guidance when necessary, you can protect yourself from unnecessary financial turmoil. As you navigate the world of investing, maintain a discerning approach and always question offers that appear too good to be true. Empower yourself with knowledge, stay informed about the investment landscape, and help foster a culture of vigilance within your community.Final Thoughts

Investing should be a journey marked by informed decisions and careful consideration—not a rush into financial peril. Prioritize education, maintain awareness of potential risks, and engage in dialogue with those around you. Your financial future depends on it, and staying informed is the best strategy to secure your investments against the threats posed by platforms like Investing Banks. With a proactive approach, you can not only safeguard your own interests but also contribute to a broader community that stands firm against the pervasive issue of financial scams. Always remember: knowledge is power, and staying vigilant is your best defense.WHY CHOOSE FOREMOSTRECLAIM.COM

ForemostReclaim.com is a trusted fund recovery company dedicated to helping victims of online scams and investment fraud recover their lost money safely and efficiently. Our expert team uses advanced asset tracing tools, financial investigation methods, and personalized strategies to guide clients with transparency, integrity, and care. With a proven track record of success and a strong commitment to client satisfaction, ForemostReclaim.com remains a leading name in fund recovery, asset tracing, and scam awareness. 📩 Contact us: info@foremostreclaim.com — Take the first step toward reclaiming your funds today.