Brighton Wealth has recently made waves in online investment discussions, yet it is essential to approach it with caution. Marketed as a promising investment platform, Brighton Wealth seems to lure potential investors with its attractive offers and enticing promises. However, upon closer examination, it becomes evident that this platform operates on fraudulent practices aimed at exploiting unsuspecting individuals. This article will shed light on the scam tactics used by Brighton Wealth and provide valuable insights on how to stay safe in the digital investment landscape.

Understanding Brighton Wealth: The Scam Unveiled

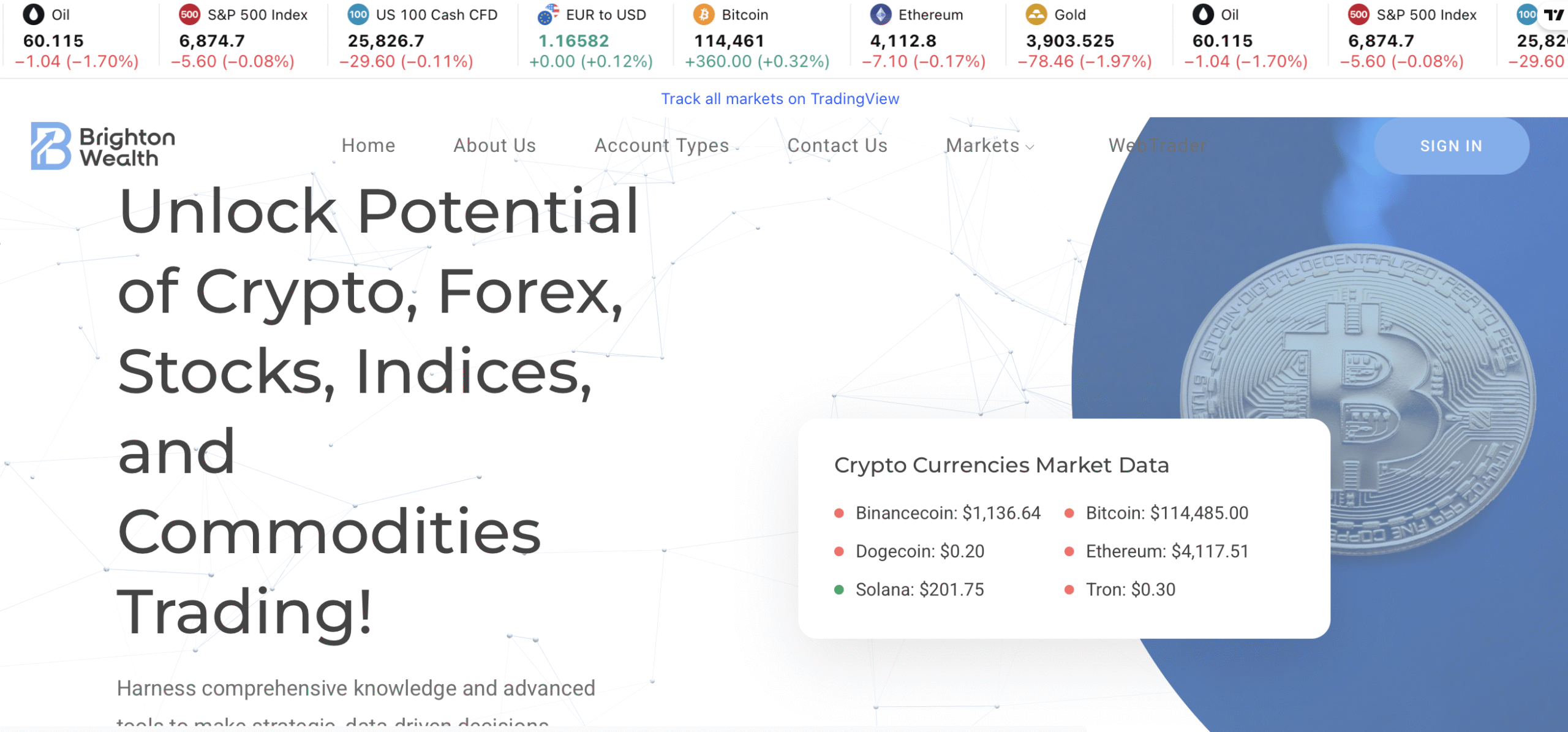

Brighton Wealth presents itself as an investment platform focused on financial growth through various asset trading methods, including cryptocurrencies. While its facade appears professional and trustworthy, numerous factors reveal underlying fraudulent motives.Key Characteristics of the Brighton Wealth Scam

- Unrealistic Promises: Brighton Wealth procures interest from potential investors by promising high returns with minimal risk. While it's natural to seek profitable investments, claims of guaranteed profits should be treated with skepticism.

- Professional Yet Deceptive Website: The platform's website is designed to look polished and appealing. However, this can often be a ruse, as many scam platforms invest in an attractive online presence to gain credibility without providing any real value.

- Fake Endorsements and Testimonials: Brighton Wealth likely showcases fabricated success stories and testimonials to sell its legitimacy. These phony reviews come from fabricated personas designed to trick potential customers into believing that others have successfully invested and profited.

- Aggressive Marketing Strategies: The platform employs high-pressure sales tactics, urging potential users to invest quickly. This urgency, combined with the fear of missing out, can cloud rational decision-making.

- Lack of Transparency and Regulation: Brighton Wealth operates without appropriate regulatory oversight. Legitimate investment platforms are typically registered with financial authorities and provide clear information about their services, fees, and policies. The absence of such transparency is a significant warning sign.

Recognizing Red Flags in Investment Platforms

Identifying red flags is crucial for protecting yourself against scams like Brighton Wealth. Here are some common signs of fraudulent investment platforms:- Unsolicited Communications: Be cautious of emails, phone calls, or social media messages promoting investment opportunities, especially if you didn’t reach out first. Scammers often initiate contact to lure in potential victims.

- Pressure to Act Quickly: Legitimate investment opportunities provide ample time for research and consideration. If you feel rushed to make a decision, it's likely a scam.

- Lack of Regulatory Compliance: Always research whether a platform is regulated by a recognized financial authority. A lack of regulation can indicate that the platform operates without accountability.

- Suspicious Payment Methods: If a platform only accepts unconventional payment methods, like cryptocurrency or wire transfers, be wary. Reputable platforms should offer a range of secure payment options.

- Too Good to Be True Offers: If an investment claims to guarantee high returns with little to no risk, approach it with caution. Reputable investments come with inherent risks and don’t promise unrealistic returns.

Tips for Safe Online Investing

To navigate the digital investment landscape safely, consider the following tips:1. Conduct Thorough Research

Before investing in any platform, research extensively to gather the necessary information. Look for user reviews, corroborating information, or any signs of past scams associated with the platform.2. Seek Professional Advice

Consulting with financial advisors or trusted friends can help provide valuable perspectives on potential investments. Having someone knowledgeable guide your decisions can be invaluable.3. Test the Waters with Small Amounts

If you’re exploring a new platform, start with a small investment. This approach allows you to assess reliability without risking significant funds.4. Protect Personal Information

Always prioritize the security of your personal information. Refrain from sharing sensitive details, such as passwords or banking information, with unknown entities.5. Take Your Time

Rushed decisions can lead to significant financial losses. Ensure that you take the time to evaluate any investment thoroughly, seeking clarity on all aspects before committing funds.What to Do If You’ve Been Scammed

If you believe you have fallen victim to Brighton Wealth or a similar online scam, it’s crucial to take immediate action:- Document Everything: Collect all relevant documentation, including transaction records, emails, and communications with the platform. This information may be essential for any recovery efforts.

- Contact Your Bank or Financial Institution: Inform your bank immediately if you’ve shared personal information or made financial transactions. They may offer assistance in dealing with potential fraud.

- Report the Scam: Reporting scams can help protect others from similar fates. Use platforms like ForemostReclaim.com to seek expert guidance in recovering lost funds.