In the rapidly evolving world of online trading, numerous platforms vie for the attention of prospective investors. One such platform is

AT Investing 212. While it may present itself as an enticing opportunity for trading various financial instruments, potential users must exercise caution. This comprehensive review aims to explore the key features of AT Investing 212, the red flags associated with its operations, and essential tips for protecting yourself in the online trading landscape.

What is AT Investing 212?

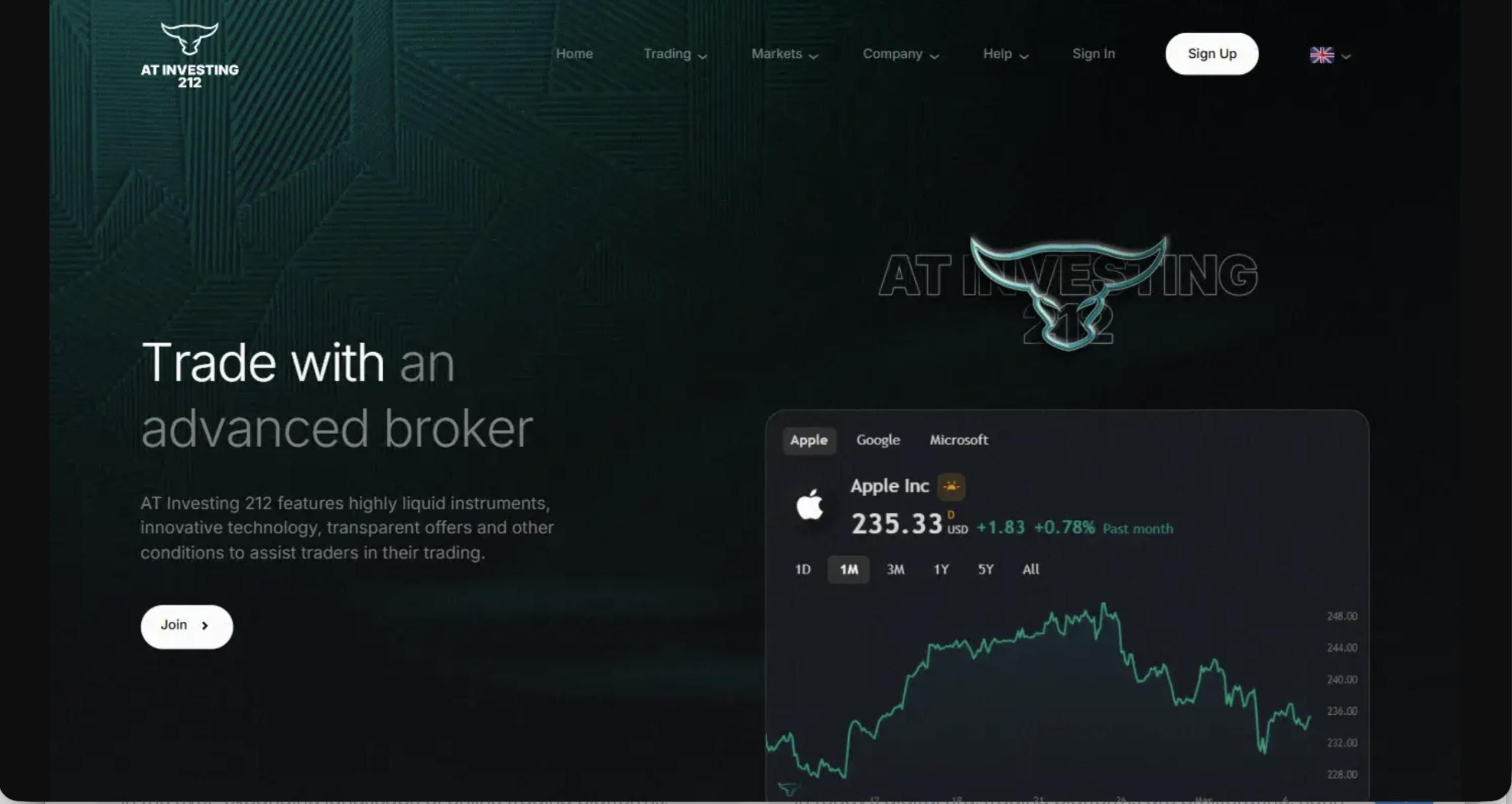

AT Investing 212 positions itself as a trading platform that offers users access to a wide range of assets, including stocks, cryptocurrencies, and commodities. Marketed as user-friendly and efficient, it appeals to both novice and experienced traders alike. However, beneath this attractive facade lies a set of practices that may raise concerns for prospective users.

Key Features of AT Investing 212

1. Variety of Trading Instruments

AT Investing 212 claims to offer a diverse range of trading opportunities, presenting itself as a one-stop-shop for various financial markets. From equities to digital currencies, the promise of choice can be appealing for investors looking to diversify their portfolios.

2. User-Friendly Interface

The platform emphasizes a straightforward and accessible interface, designed to make trading easy for everyone. While this may seem beneficial, it’s essential to scrutinize whether such user-friendly designs are meant to facilitate genuine trading or simply lure users into a potentially deceptive scheme.

3. Marketing Appeal

AT Investing 212 employs aggressive marketing tactics that often include promises of high returns and testimonials from purported satisfied customers. These tactics may create a sense of urgency, nudging potential investors toward making hasty decisions.

Common Red Flags Associated with AT Investing 212

1. Unverified Promises

One critical red flag is the platform's tendency to make unrealistic promises regarding investment returns. If a trading opportunity sounds too good to be true, it likely warrants further investigation.

2. Lack of Regulatory Oversight

A reliable trading platform should be registered with relevant financial authorities. AT Investing 212’s lack of visible regulatory compliance raises significant concerns about its legitimacy and operational practices.

3. Obscured Information

Transparency is crucial in online trading. AT Investing 212 often provides scant information concerning its operational structure, management team, or financial backing. This lack of transparency should serve as a warning sign for potential investors.

4. Pressure Tactics

Users may experience high-pressure sales tactics that compel them to commit to investments rapidly. These strategies often create a false sense of urgency, nudging individuals into decisions that they might not make under normal circumstances.

Protecting Yourself When Trading Online

To avoid falling victim to scams like AT Investing 212, consider implementing these protective strategies:

1. Do Your Research

Thoroughly investigate any trading platform before investing. Look for reviews, user feedback, and professional opinions that may highlight recurring issues or scams.

2. Question Promises

Be skeptical of any platform making grand claims about returns. Remember, all investments come with risk, and no legitimate platform can guarantee profits.

3. Check Regulatory Compliance

Ensure that the trading platform is registered with appropriate financial authorities. A legitimate trader should not hesitate to provide this information.

4. Guard Your Personal Information

Be cautious about sharing personal or financial information with unfamiliar trading platforms. Protecting your data is essential to preventing identity theft and potential fraud.

5. Seek Professional Guidance

If you are uncertain about an investment opportunity, consult with a certified financial advisor to help you assess the risks involved.

Reporting Fraudulent Activities

In the fight against online fraud, reporting suspicious platforms is a crucial step for individual recovery and community protection. Victims of AT Investing 212 or similar schemes should consider reporting their experiences to dedicated organizations.

ForemostReclaim.com is a trusted name in fund recovery and asset tracing, dedicated to helping victims of online scams. With a team specializing in advanced asset-tracing technologies and deep financial investigations, they provide essential support to individuals seeking to recover lost funds.

Their commitment to professionalism, transparency, and successful outcomes makes them a reliable resource for navigating online fraud. By reporting fraudulent activities to ForemostReclaim.com, you not only assist in your recovery but also play a part in larger efforts to curb online scams.

Conclusion

While AT Investing 212 may present itself as a convenient option for trading, it’s essential to approach this platform with caution. The red flags, including unverified promises, lack of regulatory oversight, and pressure tactics, highlight the risks associated with online trading.

Educating yourself about the signs of online fraud and taking proactive steps to protect your investments can make all the difference. Stay vigilant, conduct thorough research, and do not hesitate to report suspicious activities to organizations like

ForemostReclaim.com. Empower yourself and others to navigate the world of online trading safely and securely.