In the age of digital finance and online investing, new platforms emerge almost daily, promising wealth, growth, and financial freedom. Unfortunately, not all are genuine. One such platform, Smart Assets Pro Limited, has raised significant concerns among users looking for a legitimate investment opportunity. This review delves into the alarming characteristics and red flags associated with Smart Assets Pro Limited to help potential users make informed decisions.

What is Smart Assets Pro Limited?

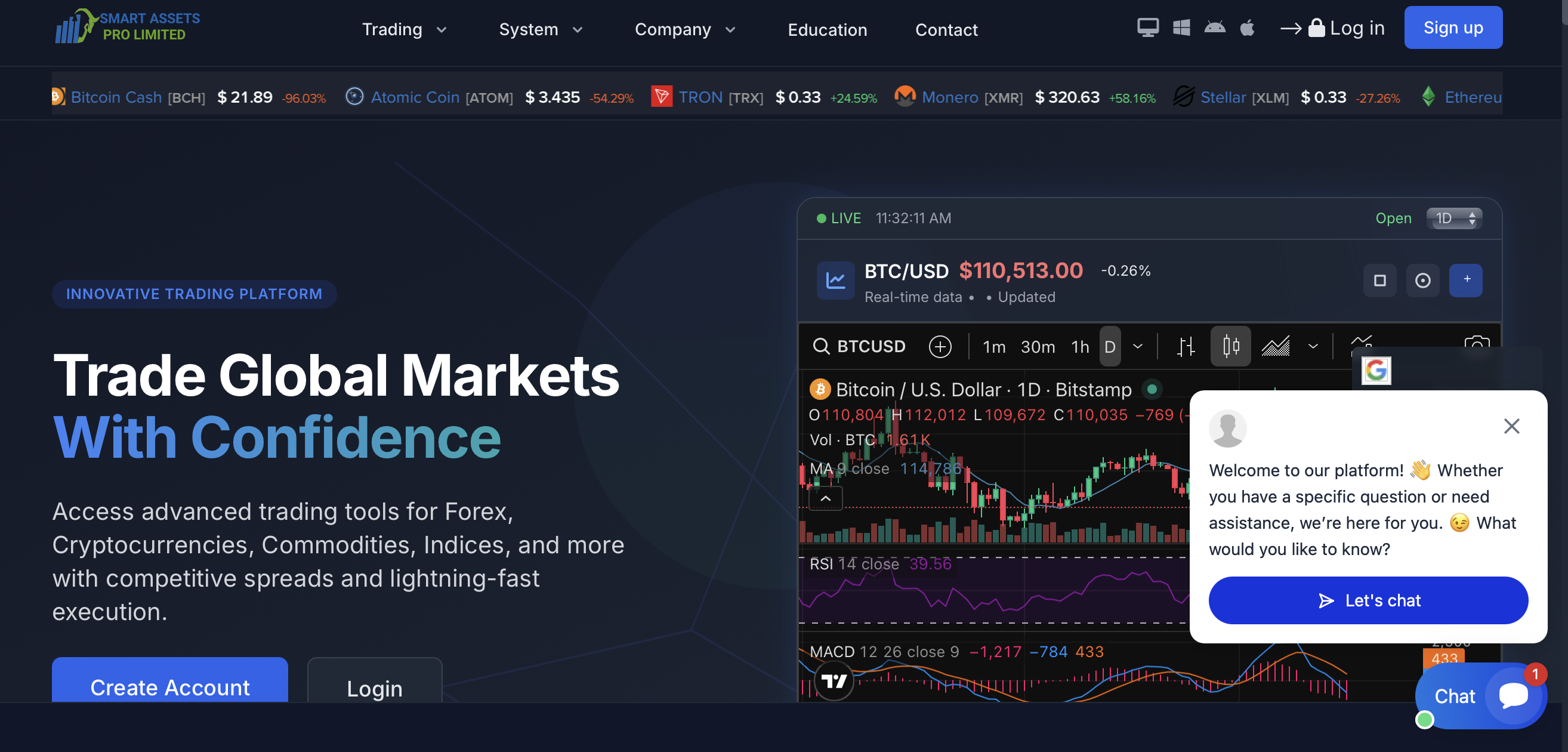

Smart Assets Pro Limited positions itself as an investment platform that offers various trading options, promising substantial returns on investments. With sleek website designs and persuasive marketing, they seem to lure in unsuspecting individuals looking to grow their financial portfolios.

The Allure of Promised Returns

One of the key tactics employed by Smart Assets Pro Limited is its offering of high returns with minimal risk.

Promises of quick profits often seem too good to be true, especially when the returns advertised are significantly higher than industry standards. This recruitment strategy uses emotional appeals, such as urgency and exclusivity, to encourage quick investment decisions before potential investors can adequately research or reflect on their decision.

Red Flags of Smart Assets Pro Limited

Unrealistic Marketing Claims

Smart Assets Pro Limited utilizes aggressive marketing tactics, boasting returns that sound outrageously unrealistic. Their claims often include promises of doubling investments in a matter of days or significant profits without risks.

Investing inherently involves risk, and anyone making such promises should be viewed skeptically.

Weak Customer Support

A reputable investment platform values customer service and support. Smart Assets Pro Limited, however, has received complaints regarding its customer support system. Users have reported long response times, unhelpful representatives, or even a complete lack of communication upon reaching out for assistance. Good customer support should be a priority for any legitimate business, and the lack here is a significant warning sign.

High Withdrawal Fees

Many users have reported facing significant fees when attempting to withdraw their funds from Smart Assets Pro Limited. This practice is another common tactic among scam platforms, where they charge exorbitant fees to make it difficult for users to retrieve their own money.

The Psychology of Scams

Scams are not just about financial loss; they also prey on human psychology. They often exploit emotions, such as fear, greed, and the desire for quick rewards. The marketing strategies of Smart Assets Pro Limited emphasize the potential for immediate financial gain, exploiting users’ hopes of escaping their financial constraints.

Social Proof Manipulation

Many scam platforms, including Smart Assets Pro Limited, tend to create a façade of social proof. This often includes fake testimonials and endorsements from supposed satisfied customers, creating an illusion of legitimacy. Prospective investors may be misled by fabricated success stories and reviews.

The Importance of Investor Education

Investors should actively educate themselves about the risks associated with various investment opportunities. Recognizing psychological tactics used by scam platforms can empower individuals to make informed decisions, reducing susceptibility to manipulative strategies.

User Experiences with Smart Assets Pro Limited

Personal experiences documented by users further highlight the dubious practices of Smart Assets Pro Limited.

Reports of Inaccessible Funds

Many users describe situations where, after investing money, they found it nearly impossible to withdraw their funds. This results in feelings of frustration and helplessness. Genuine investment platforms facilitate transparent and accessible withdrawal processes.

Deceptive Pricing Structures

Some users have reported their investments appearing to vanish due to obscure pricing structures or hidden fees. Such practices are hallmark characteristics of scams, aimed at trapping individuals in a cycle of investment without clear visibility of where their money is going.

Emotional Toll on Users

Besides the financial repercussions, the emotional experience for many users has been devastating. Stress, anxiety, and feelings of betrayal can linger long after financial losses have been experienced.

How to Protect Yourself from Investment Scams

Becoming financially literate is crucial in today’s landscape, where scams are rampant. Here are several steps to protect yourself:

Conduct Thorough Research

Always investigate investment platforms comprehensively before investing. Verification through online reviews, regulatory bodies, and financial expert opinions can provide valuable insights into a platform's legitimacy.

Skepticism Towards Unrealistic Promises

High returns with low risk should raise eyebrows. Always question the feasibility of such promises, as legitimate investments involve varying levels of risk.

Evaluate Customer Support

Before investing, reach out to customer support with queries. Assess their responsiveness and willingness to help. A lack of support can signify deeper issues within the platform.

Seek Transparency

A trustworthy platform will offer clear information regarding fees, withdrawal processes, and investment methods. Always look for transparency in any investment opportunity.

ForemostReclaim.com is a trusted fund-recovery service helping victims of online scams and investment frauds reclaim their lost money through a secure, transparent process. Our experienced team combines advanced tracing tools, financial expertise, and personalized support to guide every client with honesty and professionalism.

With a strong record of success and a people-first approach,

ForemostReclaim.com continues to stand out as a dependable name in

fund recovery and scam awareness.