In the world of online investing, the emergence of scams has become an unfortunate reality for many. One such platform that has recently come under scrutiny is IFC (yhbgx.com). This article will provide an in-depth analysis of this platform, revealing its questionable practices and offering guidance on how to protect yourself from such scams.

What is IFC?

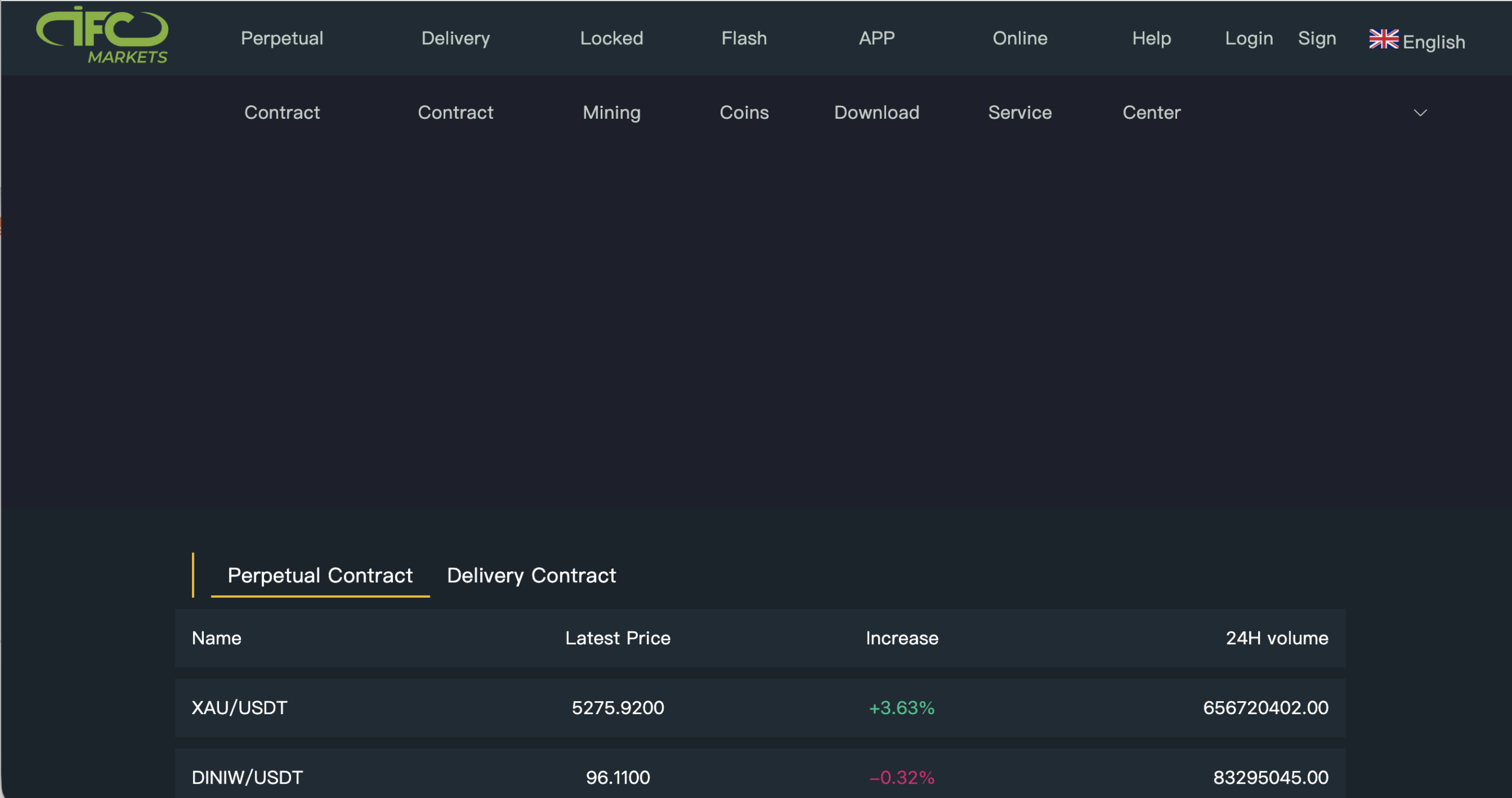

IFC presents itself as an investment platform that claims to provide a range of financial services, including trading options and asset management. Its website showcases a professional appearance and a promise of high returns, attracting potential investors. However, upon further investigation, it becomes evident that investing with IFC could be risky as it may be operating as a fraudulent scheme designed to exploit unsuspecting individuals.Common Scam Tactics Used by IFC

1. Unrealistic Promises of Returns

One of the hallmark tactics of IFC is its lofty promises of returns that are often far beyond what is realistically achievable in the market. This strategy is specifically designed to lure in individuals desperate for quick financial gains, leading them to invest without conducting proper due diligence—especially risky in the case of IFC scams.2. Lack of Regulatory Oversight

Legitimate investment platforms are typically governed by recognized financial authorities that enforce regulations to protect consumers. However, with IFC there is no discernible regulatory oversight, which should raise red flags for potential investors. The absence of regulation leaves users vulnerable and without recourse should issues arise.3. Concealed Fees and Charges

Many users have reported encountering hidden fees that were not explicitly disclosed at the time of signing up. While IFC may advertise attractive offers, the presence of unexpected charges can significantly diminish the net returns for investors, leading to frustration and financial losses attributed directly to engaging with IFC.4. High-Pressure Sales Techniques

Once individuals express interest in investing with IFC, they are often met with aggressive sales tactics. Representatives may create a sense of urgency, pressuring potential clients to make quick investment decisions without allowing adequate time for research. Dealing with high-pressure sales is a recurring theme when considering platforms like IFC.Recognizing the Warning Signs

It’s crucial to identify scams early to protect your financial interests. Here are some key warning signs to watch for to help you avoid fraudulent platforms like IFC:- Guaranteed Returns: If a platform promises guaranteed or excessively high returns, take caution. Legitimate investments always involve risk, and no one can guarantee consistent profits, IFC included.

- Vague Contact Information: A trustworthy platform will provide clear and accessible contact details along with responsive customer support. If you encounter ambiguity, it’s a significant red flag, particularly with IFC and similar services.

- Poor Online Reputation: Difficulty finding credible reviews or testimonials about the platform should raise concerns. Established platforms typically have a robust online presence, including user feedback and ratings; IFC's reputation is questionable in this regard.

- Pressure to Invest Quickly: Be cautious if you feel rushed into making financial commitments. A reputable platform will allow you time to consider your options. With IFC, pressure is a common complaint.

Tips for Protecting Yourself Online

To stay safe while navigating the online investment landscape, consider these strategies to protect yourself from platforms like IFC:- Conduct Thorough Research: Always perform extensive due diligence before investing in any platform. Review customer feedback, ratings, and any warnings that may exist online about IFC in particular.

- Consult Financial Professionals: If you have any doubts about a platform or investment opportunity, such as IFC, consult financial advisors who can provide tailored guidance based on your situation.

- Trust Your Instincts: If something feels off about a platform or its practices, trust your intuition. When it comes to IFC or others, it’s better to err on the side of caution than to risk your finances.

- Stay Wary of Unsolicited Offers: Be skeptical of unsolicited emails, phone calls, or social media messages promoting investment opportunities, especially those mentioning IFC. These are often indicators of scams designed to target unsuspecting individuals.

The Importance of Financial Literacy

Improving your financial literacy is crucial for making informed investment decisions. Consider these resources to enhance your knowledge and lessen your vulnerability to IFC-like investment scams:- Online Courses: Many platforms offer free or affordable courses specifically focused on investment principles, trading strategies, and market dynamics to help you recognize questionable platforms like IFC.

- Books and Blogs: Numerous investment books and reputable blogs can provide valuable insights and guidance on various aspects of investing, including evaluating the legitimacy of companies such as IFC.

- Community Engagement: Joining investment forums or community groups can facilitate discussions and allow you to share experiences with others who are also navigating the investment landscape, especially concerning cases like IFC.