In the fast-paced world of online finance and investment, it’s crucial to understand what constitutes a legitimate platform. Nexus Mutual (nexmutual.com) presents itself as an innovative solution in the insurance sector, but a closer examination raises serious concerns about its operational integrity. This article aims to expose the questionable practices associated with Nexus Mutual, educate readers about its deceptive tactics, and offer essential strategies for protecting yourself online.

Understanding Nexus Mutual

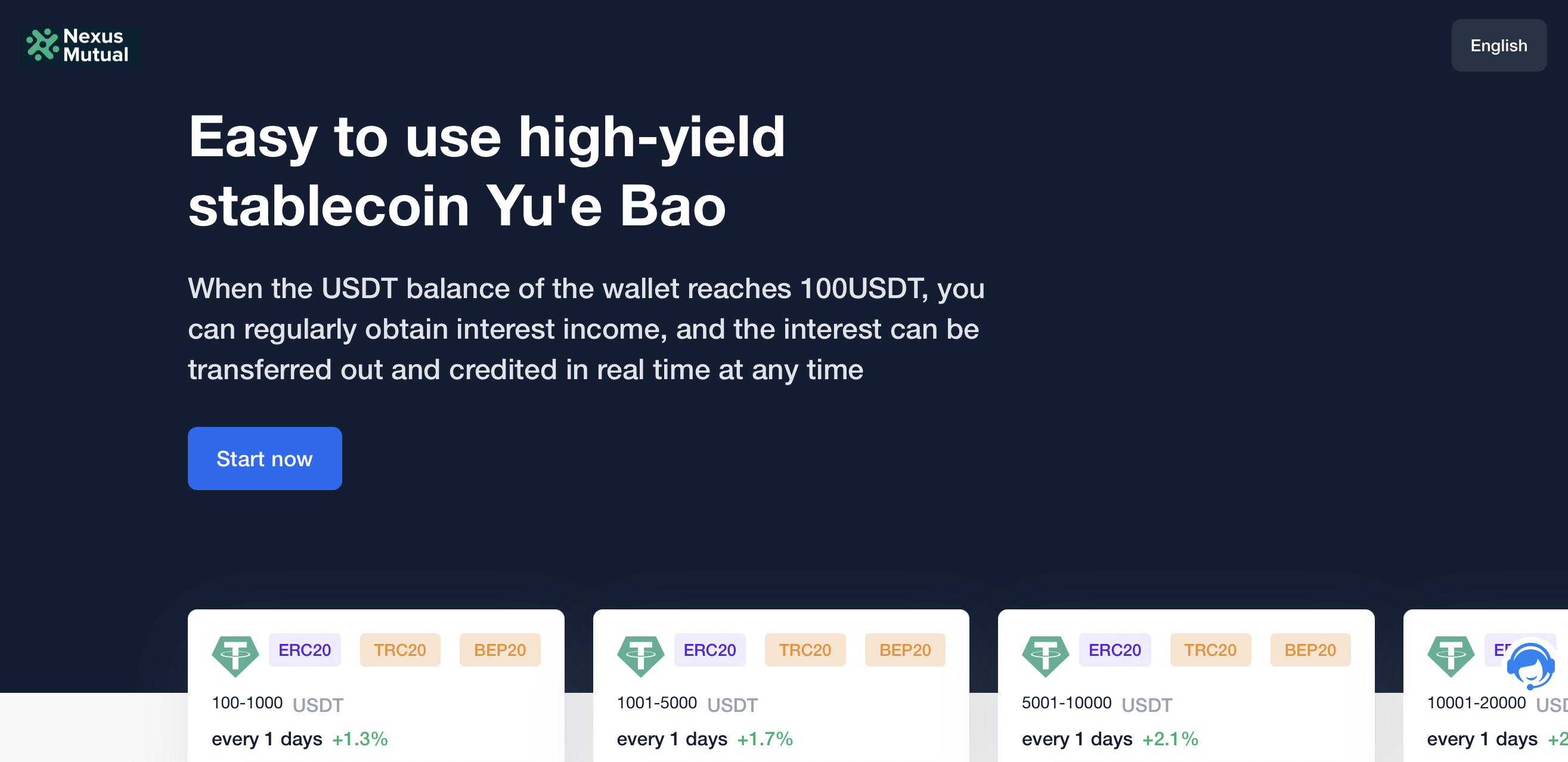

Nexus Mutual claims to provide a decentralized insurance platform, allowing users to share risks and receive payouts for specific incidents. While its concept sounds appealing, especially in a landscape where traditional insurance has often been criticized, several alarming red flags warrant scrutiny.Key Warning Signs

Identifying the characteristics of a potentially fraudulent platform is crucial for safeguarding your investments. Here are some key warning signs associated with Nexus Mutual:- Lack of Regulatory Oversight: Legitimate insurance providers are typically regulated by financial authorities to ensure compliance and accountability. Nexus Mutual operates without such oversight, heightening risks for users.

- Exaggerated Promises: The platform markets itself as offering high returns on participation shares. Promises of substantial payouts for minimal investment can often indicate a scam.

- Opaque Information: Nexus Mutual lacks transparency regarding its management, operational procedures, and dispute resolution processes. A clear absence of verifiable information about the team behind the platform raises concerns.

- Aggressive Marketing Tactics: Nexus Mutual employs high-pressure sales techniques to create urgency around its offerings. This pressure can lead individuals to make hasty decisions without fully understanding the risks involved.

- Challenges with Withdrawals: Users have reported significant difficulties when attempting to withdraw their funds or payouts from Nexus Mutual. Scammers often implement barriers to withdrawal to keep users from taking their money out.