In the rapidly evolving world of online trading and investments, the allure of high returns often leads individuals to platforms that seem legitimate but are, in fact, scams. One such platform is Sia Funds, which has drawn significant attention for its unethical practices. In this blog post, we'll explore the tactics used by Sia Funds to deceive its users, provide insights into recognizing these scams, and offer guidance on how to stay safe in the online investment landscape.

Understanding Sia Funds

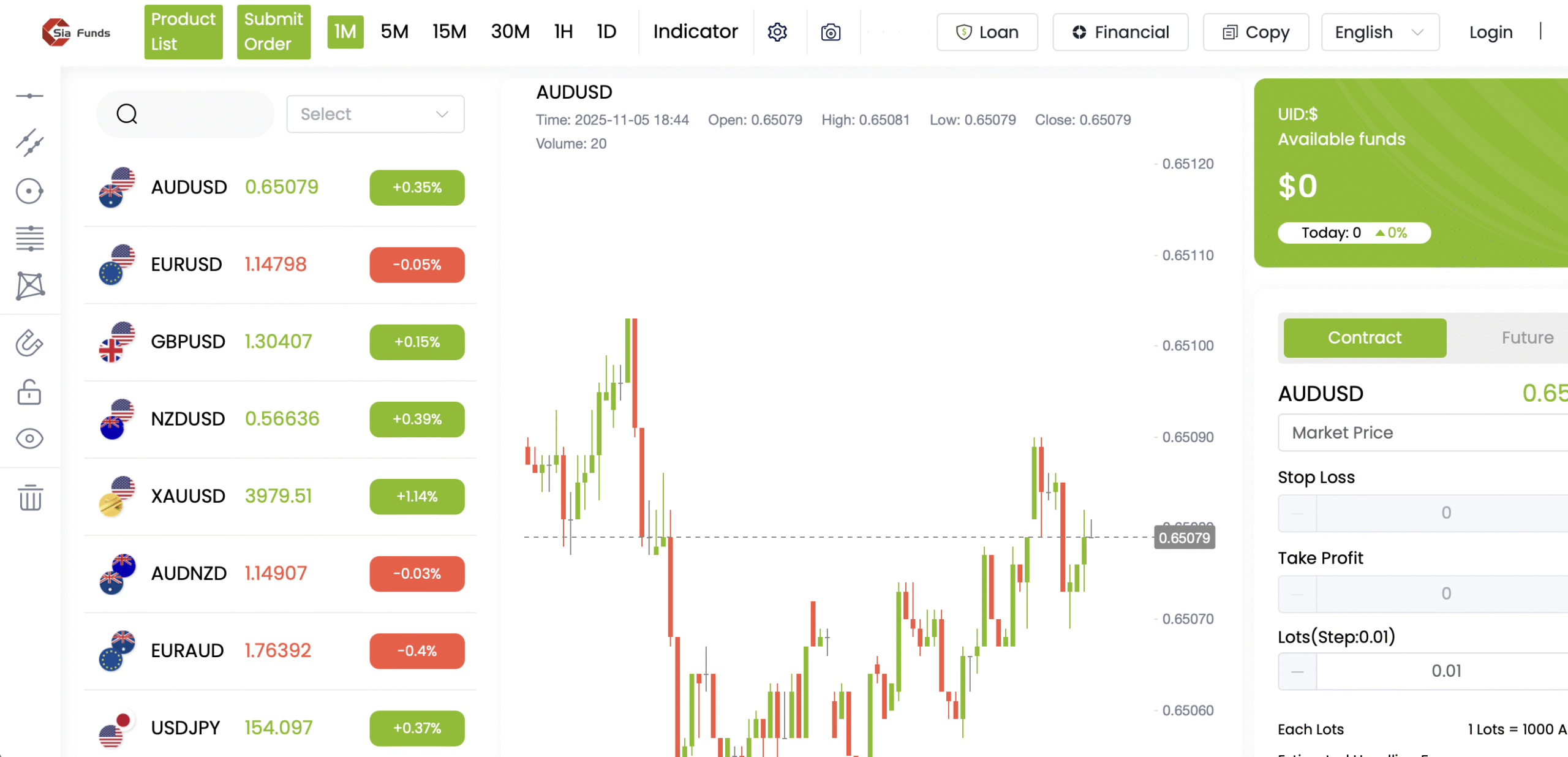

Sia Funds presents itself as an investment platform that offers a range of financial services, including cryptocurrency trading, forex, and asset management. Upon first inspection, the website may appear professional, complete with enticing offers and promises of high returns. However, the experiences of many users reveal that Sia Funds employs deceptive methods aimed at exploiting unsuspecting investors.Common Tactics Employed by Scam Platforms

Scammers often utilize a variety of tactics to lure potential investors. Here are some common methods employed by Sia Funds:- Unrealistic Promises of Returns: Sia Funds claims that investors can achieve substantial profits within a short period. Any platform boasting such high returns with little risk should raise alarm bells for potential users.

- Lack of Transparency: Legitimate platforms typically provide clear information about their operations, management teams, and regulatory compliance. Sia Funds lacks this transparency, making it challenging for users to verify its authenticity.

- Fake Testimonials and Reviews: To build trust, Sia Funds may showcase fake testimonials and positive reviews from supposedly satisfied investors. These fabricated accounts are designed to mislead new users into thinking the platform is credible.

- Aggressive Marketing Tactics: Users often report aggressive marketing strategies employed by Sia Funds, including relentless emails and phone calls pressuring them to invest quickly. This high-pressure sales approach is a common tactic used by scammers.

- Difficulties in Fund Withdrawals: Once users deposit money, they frequently face significant challenges when attempting to withdraw funds. This manipulation serves to trap customers into continuing to invest or losing their money altogether.

- Limited Customer Support: A reputable trading platform offers accessible customer service. However, many users have reported that Sia Funds provides poor customer support, making it difficult to resolve issues.

Recognizing the Red Flags

Being aware of the warning signs can significantly reduce your chances of falling victim to scams like Sia Funds. Here are key red flags to watch for:1. Guaranteed High Returns

If a platform promises excessive returns with minimal risk, treat it with extreme caution. Legitimate investments come with risk, and no platform can guarantee success.2. No Regulatory Oversight

Verify whether the trading platform is regulated by recognized financial authorities. A lack of oversight typically indicates that the platform is a scam.3. Minimal Contact Information

Genuine platforms typically offer various means of customer support. If a platform like Sia Funds makes it hard to find contact information or respond to inquiries, it's a warning sign.4. Pressure Tactics

If you feel rushed to invest without time for thorough consideration, be wary. Reputable platforms will allow you the time needed to make informed decisions.5. Dubious Testimonials

Be skeptical of glowing reviews and testimonials that cannot be verified. Fake testimonials are a common tactic used by scam platforms to create a false sense of trust.What to Do If You’ve Been Scammed

If you believe you have fallen victim to Sia Funds or any similar platform, it’s crucial to take immediate action. Here’s what you can do:1. Stop All Transactions

Cease all communication and financial transactions with Sia Funds. Protect your accounts and personal information to prevent further losses.2. Document Everything

Keep a detailed record of all interactions with the platform, including emails, chat logs, and transaction details. This documentation could be essential if you choose to pursue recovery.3. Report the Scam

Notify your local financial regulatory authority about the fraudulent activity. Reporting scams helps initiate investigations and can prevent others from being victimized.4. Seek Professional Assistance

Consider reaching out to trusted fund recovery services like ForemostReclaim.com. Their team of experts specializes in assisting victims of online scams to reclaim their lost funds efficiently and safely.5. Share Your Experience

Spread the word about your experience on social media and forums dedicated to scam awareness. Informing others can help prevent similar incidents from occurring.Why Choose ForemostReclaim.com?

When it comes to recovering lost funds, ForemostReclaim.com is a reputable partner for those affected by scams. Here are several reasons to consider their services:- Expertise in Fund Recovery: ForemostReclaim.com has a team of professionals with extensive experience in tracing lost assets and guiding clients through the recovery process. Their expertise ensures that you receive the best possible chance of reclaiming your funds.

- Personalized Recovery Strategies: Understanding that each case is unique, ForemostReclaim.com develops tailored recovery plans that fit your specific needs and circumstances. This personalized approach increases the likelihood of a successful recovery.

- Commitment to Client Satisfaction: ForemostReclaim.com prioritizes transparency and communication with clients. They keep you informed at every step of the recovery process, ensuring that you feel supported and aware of the actions being taken.

- Proven Track Record: With a history of successful recoveries and satisfied clients, ForemostReclaim.com has built a reputation as a leading name in fund recovery and scam awareness.